Editor’s Note: This is part I of a four-part series about the importance of aligning the retirement benefits an employer offers with those employees’ interests and needs.

You offer a retirement plan, but participation is not what you had expected.

Why? What’s not to love? After all, retirement plans offer benefits to employees—and employers. They give employees a way to save for their future and build long-term financial security; for employers, a retirement plan can help attract and retain employees.

Betterment at Work in its most recent Retirement Readiness report shows that the reach of retirement plans is growing—59% of employees in 2023 had access to a 401(k) or other retirement plan, while 52% had access just a year before.

That’s good news, but there is more work to do. That necessity stems in part from the fact that simply offering a plan may not be enough. And one explanation for that is that the benefits an employer offers may not match its employees’ needs as closely as they could.

SoFi at Work in its report “The Future of Workplace Financial Well-Being: 2024 Employer & Employee Perspectives” says that employees trust their employers to provide “resources, advice and programs that work.” Nonetheless, they say, there is a “clear disconnect” about what employees need and what employers provide; further, they say that there is a “communication breakdown.” And that means that employees don’t know enough about what their employer is offering.

Employee Concerns

A disconnect between the plan an employer offers and what employees need and want can result from an employer failing to recognize the concerns that may impede an employee from saving as much as they otherwise would for retirement, or perhaps even saving at all.

Harlyn Croland, Head of Business Operations & Strategy, at Betterment at Work, says that they have found that the top five factors that are “getting in the way of retirement savings” are:

1. the increasing costs of living

2. credit card debt

3. housing costs

4. medical bills/debt

5. student loans

T. Rowe Price reports similar results in its “Reference Point” report about participants’ behavior and attitudes concerning retirement plans in 2023. They found that the top five barriers to saving that participants reported were:

1. mortgage debt

2. credit card debt

3. car loans

4. inapplicability

5. student loans

SoFi at Work says that 45% of the employees it studied feel stress about having insufficient retirement savings.

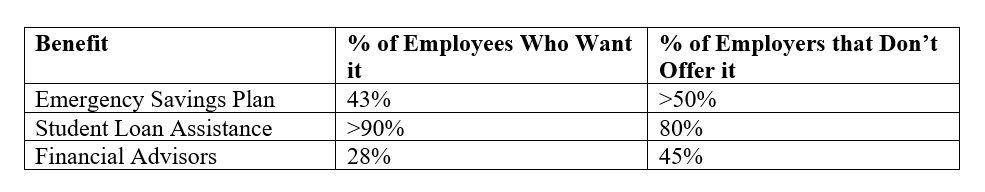

SoFi at Work provides an illustration of the disconnect between employees’ interest in particular benefits and the percentage of employers offering it.

Recognizing the sources of financial stress employees face can serve an employer in good stead and help it to better meet employees’ needs, Croland suggests. “By supporting employees to tackle these competing responsibilities, employers will empower them to start prioritizing retirement savings,” he says.

Costly for Employers

Such a misalignment can be costly for an employee due to foregone revenue for the retirement years, but Croland points out that it can be costly for an employer as well.

SoFi at Work reports that 55% of human resources professionals recognize that financial stress affects employees’ mental health, and 40% say it affects employees’ productivity and ability to focus. Employees themselves recognize that, too—their study shows that 25% of employees report that financial stress makes them less productive and confident at work.

Not only that, Croland notes, the disconnect could even result in the more dire consequence of losing employees. “Our survey found that 60% of employees would be enticed to leave their job by an employer that offers better financial benefits than their current employer,” he says.

Just Ask!

If an employer finds that participation in its plan is not what it expected, says Croland, it needs to understand what roadblocks may prevent employees from participating or contributing more to their retirement plan accounts.

SoFi at Work argues that there is a simple solution: ask employees what they need, and listen to them. They advocate using internal surveys at least twice a year, as well as one-on-one meetings with managers, to find out more about the financial stresses employees face and are experiencing so the employer can offer benefits that better meet employees’ needs.

Croland, too, suggests that an employer conduct its own internal research “to better understand the financial headwinds and tailor a benefits package that reflects the priorities of their employees.”

Next: Action steps an employer can take to better align benefits with employees’ needs and interests

- Log in to post comments